Buying your first home is a huge milestone and, let’s be honest, probably the biggest financial move you’ll ever make. Between saving for your mortgage deposit, paying legal fees, and all other moving costs, there is one more surprise expense you might not be expecting: Stamp Duty Land Tax, or SDLT. If you’re a first-time buyer in England or Northern Ireland, you may qualify for Stamp Duty relief. Meaning you could pay less or nothing at all. In this guide, we’ll walk you through what’s changing with first-time buyer stamp duty in 2025, who qualifies, how much you could save, and how to claim it.

What Is Stamp Duty Land Tax (SDLT)?

Stamp Duty Land Tax is a government tax charged when you buy residential property or land in England or Northern Ireland. It’s calculated based on how much the property costs.

You usually pay it within 14 days of completing your purchase, but don’t worry; it’s often handled by your solicitor or conveyancer as part of the homebuying process. Think of SDLT as a kind of entry fee for owning property set by the government.

Stamp Duty for First-Time Buyers in 2025: What’s Changing?

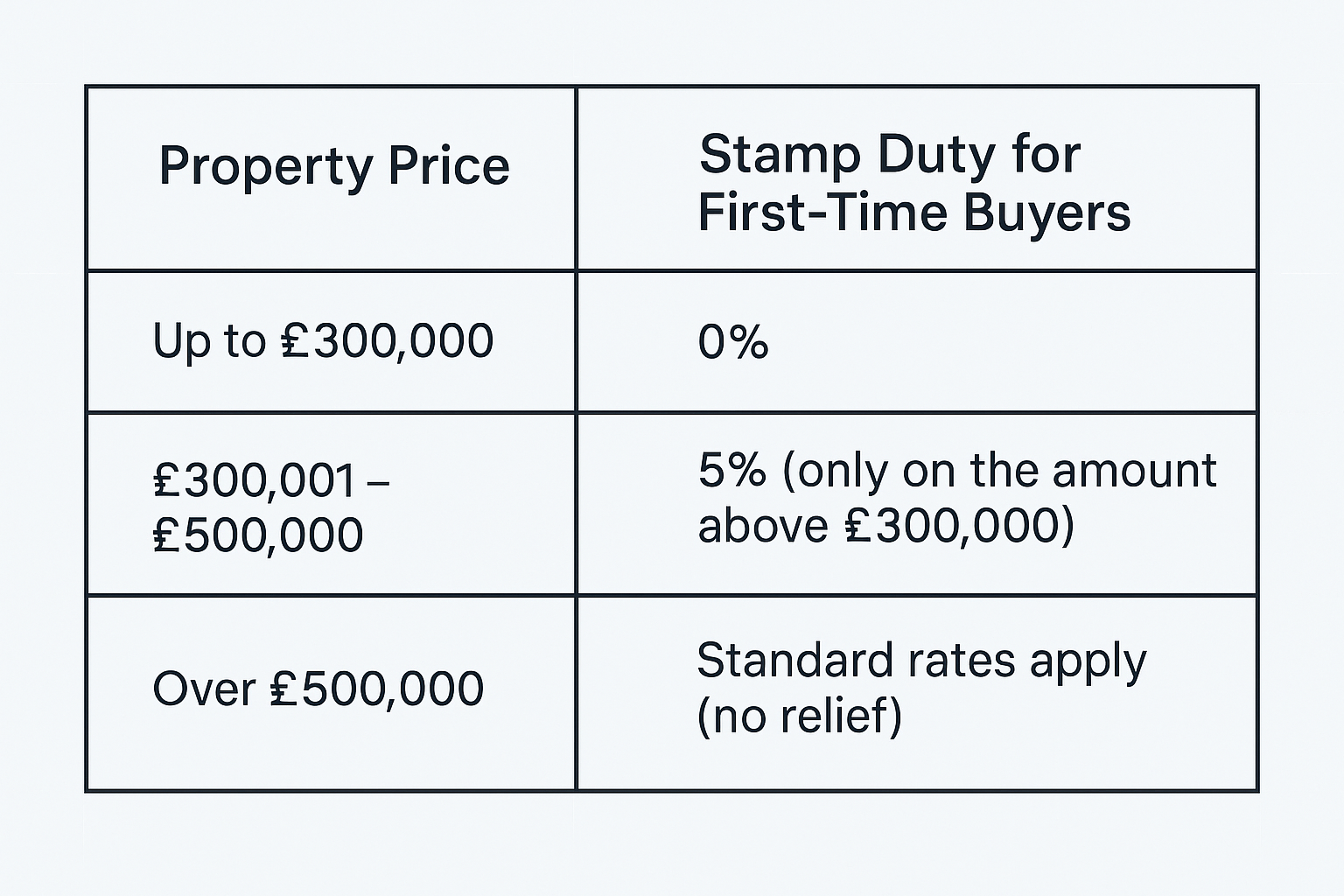

As of 1 April 2025, the rules for stamp duty first-time buyers are shifting back to what they were before the 2022 thresholds. This change may affect your affordability. Here’s what it means in plain English:

So yes, if your property costs more than half a million, there’s no special treatment. You’ll pay the full standard rates like everyone else.

Do first-time buyers pay stamp duty? Well, it depends:

- You don’t pay any SDLT on the first £300,000.

- If your property costs fall between £300,001 and £500,000, you’ll only pay 5% on the portion above £300,000.

- Buying for more than £500,000? Full rates apply, and you won’t qualify for stamp duty exemption that first-time buyers typically get.

This change ends the temporary relief that raised the zero-rate band to £425,000, which expired in March 2025.

Who Qualifies for First-Time Buyer Stamp Duty Relief?

Not sure who qualifies for first-time buyer relief? To be eligible:

- You have never owned a freehold or leasehold residential property anywhere in the world.

- You are buying the property to live in, not to rent out or use as a holiday home.

- If you are buying jointly, they must also be a first-time buyer.

- Inherited a house at some point? Owned an apartment overseas? Unfortunately, you will not qualify for stamp duty relief for first-time buyers.

It’s strict, but the rules are clear. Everyone on the purchase must be genuinely buying their first home to get the relief.

Real-Life Example: How Much Could You Save?

Scenario 1: Here’s a quick breakdown of how first-time buyer stamp duty relief can save you £4,000 on a £280,000 home.

- First-Time Buyer: £0 SDLT

- Without Relief: £4,000 SDLT

Savings: That’s a £4,000 saving, straight back into your pocket.

Scenario 2: Now, consider a home for £400,000

- First £300,000: 0% SDLT

- Remaining £100,000: 5% = £5,000

- Total SDLT: £5,000

- Without Relief: £10,000

Savings: That’s a £5,000 saving with first-time buyer stamp duty relief.

Example 3: For a property costing £510,000

- This is above the £500,000 threshold, so you’ll pay the full standard rate.

- For this price, SDLT would be around £15,500. No relief available, sadly.

How do you claim the Stamp Duty Exemption for First-Time Buyers?

Don’t panic; you have good news: it’s not too complicated.

When you or your solicitor submits your SDLT return to HMRC, you’ll just need to tick the box saying you’re a first-time buyer. Most solicitors handle this automatically, but it’s a good idea to double-check.

👉 Just say: “Hey, I’m a first-time buyer, can you make sure the relief’s applied?”

Even if no SDLT is due, an SDLT return must still be submitted for properties over £40,000.

What if you are buying in Scotland or Wales?

Stamp Duty Land Tax only applies in England and Northern Ireland. Other parts of the UK have their own systems:

Scotland: You’ll pay Land and Buildings Transaction Tax (LBTT). First-time buyers get relief on the first £175,000.

Wales: Uses Land Transaction Tax (LTT). Sadly, no specific relief for first-time buyers at the moment.

A Few Quick Reminders

- Do first-time buyers pay stamp duty? Not if your property is under £300,000.

- If it’s £300,001–£500,000, you pay 5% only on the amount over £300,000.

- No relief applies if the property is over £500,000.

- Stamp duty first buyers 2025 rules revert to pre-2022 thresholds.

- Use the official HMRC Stamp Duty Calculator to check exactly how much you’ll owe.

- Don’t assume relief is automatic, you have to claim it as part of the process.

Final Thoughts

Stamp duty for first-time buyers in 2025 can be one of those hidden costs that can really surprise you. But knowing the 2025 relief rules means you can plan better, save money and make smarter financial decisions.

And who knows? That £5,000 saving might be just what you need for your first furniture set… Or maybe a kitchen upgrade you’ve been dreaming of.